1098-T Tuition Statement - Frequently Asked Questions

San Mateo County Community College District

(College of San Mateo, Skyline College, Cañada College)

When completing your tax return, it is recommended that you review your 1098-T along with your financial activity contained within your Student Fee Account Summary By Term. Simply log on to WebSMART and go to “Student Services” and then “Student Account". Click on “Account Summary by Term”. Your summary detailing your financial activity will be displayed.

Disclaimer: The information provided in this document is NOT tax advice.

It is offered only as general information for San Mateo County Community College District students and their families. For any question on computing, claiming or determining qualification for any tax benefit mentioned in this document, please consult with a qualified tax professional and review the IRS Tax Benefits for Education information at:

English Español

General Questions

- Why did I receive the Form 1098T? What is its purpose?

- What is an Education Tax Credit?

- Is my 1098-T statement available online?

- Who should I contact if I need further assistance or cannot find my answers from this FAQ?

Specific information – Refers to specific box numbers on the 1098-T form

- Box 1. Payment Received for qualified tuition and related expenses

- Box 2. Reserved

- Box 3. Reserved

- Box 4. Adjustments made for a prior year

- Box 5. Scholarships or grants

- Box 6. Adjustments to scholarships or grants for a prior year

- Box 7. Checked if the amount in Box 1 or 2 includes amounts for an academic period beginning January - March of the new tax year

- Box 8. Checked if at least a half-time student

- Box 9. Checked if a graduate student

- Box 10. Insurance contract reimbursements or refunds

General Questions

Why did I receive the Form 1098T? What is its purpose?

THIS IS NOT A BILL OR REQUEST FOR PAYMENT

The IRS requires educational institutions to report to students the amount of qualified tuition and related expenses (fees) billed to them or paid by them during the calendar year. Beginning in tax year 2018, the San Mateo County Community College District (SMCCCD) reports the total amount paid (not billed) for the calendar year. The purpose of the form is to help determine whether you are eligible to claim an Education Tax Credit on your income tax returns. The 1098-T tuition statement has been furnished to you by the SMCCCD if you were enrolled in one or more of our three colleges: College of San Mateo, Skyline College, and Cañada College.

What is an Education Tax Credit?

The Federal government currently allows for educational tax credits called The American Opportunity Tax Credit" and "Life Time Learning Credit." These credits are designed to reduce the income taxes paid by those students who pay their college tuition fees and course materials. Detailed information can be found in IRS Publication 970 . If you meet the eligibility requirements, the credits may be used to reduce the amount of income tax you have to pay. Generally, you may be eligible to claim education credits if:

- You pay qualified tuition and related expenses of higher education

- You pay the tuition and related expenses for an eligible student

- The eligible student is either yourself, your spouse or a dependent for whom you can claim an exemption on your tax return (for example, your dependent child)

Is my 1098-T statement available online?

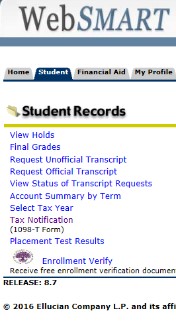

Yes, you can access the electronic version of your 1098-T tuition statement. Simply log on to WebSMART and go to “Student Services” and then “Student Records." Click on Tax Notification (1098-T Form) as seen on the screen shot below.

Your electronic 1098-T, with a detailed breakdown of each amount shown, will be displayed.

Who should I contact if I need further assistance or cannot find my answers from this FAQ?

- For Box 1 Qualified tuition and related expenses questions – please contact the Cashier’s Office at your college (see below)

- For Box 5 Scholarship or Grants questions – please contact the Financial Aid Office at your college (see below)

If your personal information (name, social security number, address, etc.) is incorrect, please contact the Admissions and Records Office at your college (see below). Our staff will assist you in making the necessary corrections or updates. Please do not email your Social Security Number.

College Financial Aid Office Cashier Office Admissions and Records Office Skyline

(650) 738-4236

Financial Aid Contact Form(650) 738-4101

skylinecashier@smccd.edu(650) 738-4251

Admissions Contact FormCanada

(650) 306-3308

canadafinancialaid@smccd.edu(650) 306-3270

canadacashiers@smccd.edu(650) 306-3226

canadaadmission@smccd.eduCSM

(650) 574-6147

csmfinancialaid@smccd.edu(650) 574-6412

csmcashiers@smccd.edu(650) 574-6165

csmadmission@smccd.edu

Specific information – Refers to specific box numbers on the 1098-T form

Box 1. Payment Received for qualified tuition and related expenses

The IRS requires educational institutions to report payments received (Box 1) for qualified tuition and related expenses on the 1098-T tuition statement. The SMCCCD currently reports only qualified tuition and related expenses received from you or other sources during the tax year (January to December) in Box 1.

Examples of qualified tuition and related expenses included in Box 1:

- Enrollment Fees [includes those paid under the “Free College” program or waived as a recipient of California College Promise Grant/waiver (CCPG)]

- Materials Fees (includes those paid under the “Free College” program)

- Non-Resident Tuition Fees

- Non-Resident Capital Outlay Fees

- Audit Fees

- Student Body Fees (includes those paid under the “Free College” program)

- Student Representation Fees (includes those paid under the “Free College” program)

- Student Union Fees (Skyline College only) (includes those paid under the “Free College” program)

Examples of other fees that are NOT included in Box 1:

- Health Fees

- Parking Fees

Box 2. Reserved

Box 3. Reserved

Box 4. Adjustments made for a prior year

Illustrates any adjustment(s) made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T.Box 5. Scholarships or grants

Illustrates the total amount of all scholarships and/or grants administered and processed by your college for the calendar year.

Examples of scholarships or grants included in Box 5:

- Promise Scholars Program Scholarships

- SMCCC Foundation Scholarships

- Outside/External Scholarships (e.g., Rotary, Elks Club, PG&E, etc.)

- Pell Grants (federal financial aid grant)

- Cal Grants (state financial aid grant)

- “Free College” Program

- Emergency Financial Aid Grants and/or Disaster Relief Payments - for more information

regarding Higher Education Emergency Relief Fund and Emergency Financial Aid with

regards to COVID-19 Emergency Financial Aid Grants please see:

https://www.irs.gov/newsroom/higher-education-emergency-grants-frequently-asked-questions

Examples of scholarships or grants NOT included in Box 5:

- Promise Scholars Program Incentives (e.g., gas cards and/or gift cards)

- Food vouchers / gift cards for food insecurity (e.g., Tango / SAM Cards)

For reporting the above scholarships or grants, please consult with a qualified tax professional and review the IRS Tax Benefits for Education at the IRS Information Center.

Box 6. Adjustments to scholarships or grants for a prior year

Illustrates any adjustment(s) made for a prior year for scholarships or grants that were reported on a prior year Form 1098-T.Box 7. Checked if the amount in Box 1 or 2 includes amounts for an academic period beginning January - March of the new tax year

Indicates whether the amount in Box 1 or 2 includes amounts for an academic period beginning January-March of the subsequent year.Box 8. Checked if at least a half-time student

Indicates whether you are considered to be carrying 6 units, (i.e. at least one-half the normal full-time workload for your course of study at the reporting institution).Box 9. Checked if a graduate student

Indicates whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential.Box 10. Insurance contract reimbursements or refunds

Illustrates the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer (e.g., third-party sponsor).